In the U.S., advances in drilling technologies, such as horizontal drilling and hydraulic fracturing, have brought about a veritable energy renaissance.

Thanks to staggering production growth from shale oil plays previously thought inaccessible, U.S. oil output is the highest it's been since at least 1998. Some experts are even suggesting that the shale revolution could help bring about energy independence as early as 2020.

But while the U.S. may have been a first-mover in applying advanced drilling technologies to shale fields, it's not the only nation endowed with vast shale reserves. In fact, China may hold 1,275 trillion cubic feet of technically recoverable shale gas, according to data from the U.S. Energy Information Administration. If accurate, that's nearly 50% more than America's 862 trillion cubic of recoverable reserves. �

Will China and other countries around the world see the same success with shale drilling that America has?

A global shale revolution?

Probably not any time soon. According to Andrew Brown, head of international oil and gas production at Royal Dutch Shell (NYSE: RDS-A ) , shale development in the rest of the world won't proceed as quickly as it has in North America.

Top 5 Growth Companies To Own For 2014: TrueBlue Inc.(TBI)

TrueBlue, Inc. provides temporary blue-collar staffing services in the United States. It supplies on demand general labor to various industries under the Labor Ready brand; skilled labor to manufacturing and logistics industries under the Spartan Staffing brand; and trades people for commercial, industrial, and residential construction, and building and plant maintenance industries under the CLP Resources brand. The company also provides mechanics and technicians to the aviation maintenance, repair and overhaul, aerospace manufacturing, and assembly industries, as well as to other transportation industries under the Plane Techs brand; and temporary drivers to the transportation and distribution industries under the Centerline brand. It primarily serves small and medium-size businesses. The company was formerly known as Labor Ready, Inc. and changed its name to TrueBlue, Inc. in December 2007. TrueBlue, Inc. was founded in 1985 and is headquartered in Tacoma, Washington.

Advisors' Opinion: - [By Jonathan Yates]

For those looking to invest in real estate stocks, highly recommended is the Dr. Housing Bubble blog. In a recent posting, the "Dr." pointed out that there was a "Lost Generation" when it came to household income. That has not happened for those investing in staffing industry stocks such as Paychex (NASDAQ: PAYX), Robert Half International (NYSE: RHI), TrueBlue, Inc. (NYSE: TBI), and Labor SMART (OTCBB: LTNC).

- [By idahansen]

The entire demand labor industry should do well as the US Department of Labor just reported that 169,000 more jobs were added to the American economy. The more work there is, the more demand there is for the services of staffing solutions firms such as Labor SMART, Paychex (NASDAQ: PAYX), TrueBlue (NYSE: TBI), and Robert Half International (NYSE: RHI).

- [By Jonathan Yates]

When looking at small cap stocks, it is useful to compare the company with others that have expanded in both share price and size. For those considering investing in the $100 billion staffing industry, the growth of TrueBlue (NYSE: TBI) shows what could be the potential path for Labor SMART (OTCBB: LTNC), as both operate in the $29 billion demand labor sector. Other firms have done well in the staffing industry include Paychex (NASDAQ: PAYX) and ManPower Group (NYSE: MAN).

- [By Jonathan Yates]

Even though the stock market rallied on Federal Reserve Chairman Ben Bernanke's remarks with the Dow Jones Industrial Average (NYSE: DIA) and Standard & Poor's 500 Index (NYSE: SPY) surging, the long term winners will be stocks in the staffing industry such as Paychex(NASDAQ: PAYX), TrueBlue (NYSE: TBI), Robert Half (NYSE: RHI), and Labor SMART (OTCBB: LTNC).

Top 5 Growth Companies To Own For 2014: Eastern Insurance Holdings Inc.(EIHI)

Eastern Insurance Holdings, Inc., through its subsidiaries, provides workers compensation insurance and reinsurance products in the United States. The company?s Workers Compensation Insurance segment provides traditional workers compensation insurance coverage products, including guaranteed cost policies, policyholder dividend policies, retrospectively-rated policies, deductible policies, and alternative market products to employers. This segment distributes its workers? compensation products and services through its independent insurance agents primarily in Pennsylvania, Delaware, North Carolina, Maryland, Indiana, and Virginia. Its Segregated Portfolio Cell Reinsurance segment offers alternative market workers compensation solutions comprising program design, fronting, claims administration, risk management, segregated portfolio cell rental, asset management, and segregated portfolio management services to individual companies, groups, and associations. Eastern Insurance Holdings, Inc. is headquartered in Lancaster, Pennsylvania.

Advisors' Opinion: - [By Lauren Pollock]

ProAssurance Corp.(PRA) agreed to acquire Eastern Insurance Holdings Inc.(EIHI) for about $205 million, expanding the insurance company’s casualty insurance offerings. Eastern Insurance is a domestic casualty insurance group specializing in workers’ compensation products and services, among other things. ProAssurance plans to pay $24.50 in cash for each outstanding Eastern share, a 16% premium over Monday’s closing price.

Thoratec Corporation engages in the development, manufacture, and marketing of proprietary medical devices used for circulatory support. The company?s primary product lines include ventricular assist devices, such as HeartMate II, an implantable left ventricular assist device consisting of a rotary blood pump to provide intermediate and long-term mechanical circulatory support (MCS); and HeartMate XVE, an implantable and pulsatile left ventricular assist device for intermediate and longer-term MCS. Its ventricular assist devices also comprise Paracorporeal Ventricular Assist Device, an external pulsatile ventricular assist device, which provides left, right, and biventricular MCS approved for bridge-to-transplantation (BTT), including home discharge, and post-cardiotomy myocardial recovery; and Implantable Ventricular Assist Device, an implantable and pulsatile ventricular assist device designed to provide left, right, and biventricular MCS approved for BTT comprising hom e discharge, and post-cardiotomy myocardial recovery. The company also provides CentriMag, an extracorporeal full-flow acute surgical support platform that offers support up to 30 days for cardiac and respiratory failure. In addition, it offers PediMag and PediVAS extracorporeal full-flow acute surgical support platforms designed to provide acute surgical support to pediatric patients. The company sells its products through direct sales force in the United States, as well as through a network of distributors internationally. Thoratec Corporation was founded in 1976 and is headquartered in Pleasanton, California.

Advisors' Opinion: Top 5 Growth Companies To Own For 2014: MEDIFAST INC(MED)

Medifast, Inc., through its subsidiaries, engages in the production, distribution, and sale of weight management and disease management products, and other consumable health and diet products in the United States. The company?s product lines include weight and disease management, meal replacement, and vitamins. It also operates weight control centers that offer Medifast programs for weight loss and maintenance, customized patient counseling, and inbody composition analysis. The company markets its products under the Medifast and Essential brand names, including shakes, appetite suppression shakes, women?s health shakes, diabetics shakes, joint health shakes, coronary health shakes, calorie burn drinks, calorie burn flavor infusers, antioxidant shakes, antioxidant flavor infusers, bars, crunch bars, soups, chili, oatmeal, pudding, scrambled eggs, hot cocoa, cappuccino, chai latte, iced teas, fruit drinks, pretzels, puffs, brownie, pancakes, soy crisps, crackers, and omega 3 and digestive health products. Medifast Inc. sells its products through various channels of distribution comprising Web, call center, independent health advisors, medical professionals, weight loss clinics, and direct consumer marketing supported via the phone and the Web; Take Shape for Life, a physician led network of independent health coaches; and weight control centers. The company was founded in 1980 and is headquartered in Owings Mills, Maryland.

Advisors' Opinion: - [By Holly LaFon] ast produces, distributes and sells weight and health management products with the brand names Medifast, Take Shape for Life, Hi-Energy Weight Control Centers and Woman�� Wellbeing.

Its return on assets in the third quarter of 2011 was 19.6%, which has been increasing in the past several years. The average return on assets for the specialty retail industry is 10.48% for the trailing 12 months.

The company�� total assets amounted to $94 million in 2010, which increased from $62.8 million in 2009. Net income also increased to $19.6 million in 2010 from $12 million in 2009.

Boston Beer Inc. (SAM)

Boston Beer Inc. is the largest brewer of handcrafted beers in America. Boston Beer is a growing company that recently saw a large increase in its return on assets. It increased from 19.3% in 2010 to 29.7% in 2011, and was negative as recently as 2008. The average return on assets for the beverages industry in the trailing 12 months is 9.47%.

In 2011, the company�� total assets increased to $272.5 million from $258.5 million in 2010. Net income increased to $66 million from $50 million.

Alliances Resources Partners (ARLP)

Alliance Resources Partners is a coal producer and marketer primarily in the eastern U.S. Its ROA has been increasing since 2008 and increased to 22.5% in 2011 from 21.4% in 2010. The average return on assets for the oil, gas & consumable fuels industry in the trailing 12 months is 24.47%.

In 2011, its total assets increased to $1.7 billion from $1.1 billion in 2010. Its net income increased to $389 million from $321 million.

Factset Research Systems Inc. (FDS)

Factset researches global market trends and develops analytical tools for investors. Of all of GuruFocus��5-star predictable companies, it has the highest return on assets at 27%. ROA has been increasing over the past several years. The average return on assets for the software industry for the trailing 12 m

- [By Jon C. Ogg]

Medifast Inc. (NYSE: MED) saw its stock down 5% in evening trading on Tuesday after the weight loss player had soft sales and guided expectations lower. Shares were still indicated down about 5%, but volume has not yet started.

Top 5 Growth Companies To Own For 2014: Crocs Inc.(CROX)

Crocs, Inc. and its subsidiaries engage in the design, development, manufacture, marketing, and distribution of footwear, apparel, and accessories for men, women, and children. The company primarily offers casual and athletic shoes, and shoe charms. It also designs and sells a range of footwear and accessories that utilize its proprietary closed cell-resin, called Croslite. The company?s footwear products include boots, sandals, sneakers, mules, and flats. In addition, it provides footwear products for the hospital, restaurant, hotel, and hospitality markets, as well as general foot care and diabetic-needs markets. Further, the company offers leather and ethylene vinyl acetate based footwear, sandals, and printed apparels principally for the beach, adventure, and action sports markets; and accessories comprising snap-on charms. The company sells its products through the United States and international retailers and distributors, as well as directly to end-user consumers th rough its company-operated retail stores, outlets, kiosks, and Web stores primarily under the Crocs Work, Crocs Rx, Jibbitz, Ocean Minded, and YOU by Crocs brand names. As of December 31, 2010, it operated 164 retail kiosks located in malls and other high foot traffic areas; 138 retail stores; 76 outlet stores; and 46 Web stores. Crocs, Inc. operates in the Americas, Europe, and Asia. The company was formerly known as Western Brands, LLC and changed its name to Crocs, Inc. in January 2005. Crocs, Inc. was founded in 1999 and is headquartered in Niwot, Colorado.

Advisors' Opinion: - [By James Brumley]

The next Crocs (CROX) earnings announcement is coming after the market closes Wednesday, Oct. 30, and if this report is anything like most Crocs earnings updates … well, investors have a 50-50 shot at hearing good news.

- [By Rich Bieglmeier]

According to Yahoo finance, Crocs, Inc. (CROX) will release its third quarter financial results on Monday, October 21, 2013; however, the company's investor's relations page makes no note of any impending announcements. That being said, CROX normally reports Q3 EPS around October 24th. So, next Thursday-ish instead of Monday is possible.

PNRA data by YCharts

PNRA data by YCharts  NOW data by YCharts

NOW data by YCharts  AOL data by YCharts

AOL data by YCharts  STJ data by YCharts

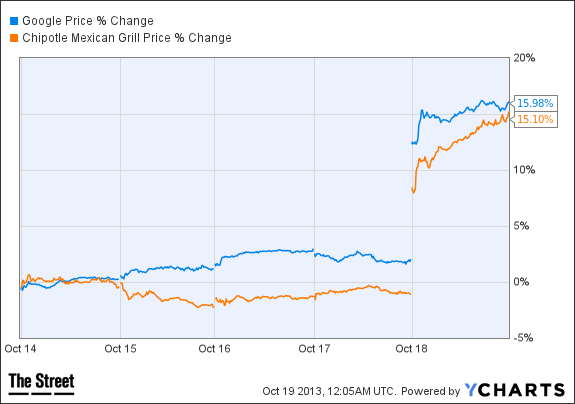

STJ data by YCharts  GOOG data by YCharts

GOOG data by YCharts

Hosted by Marketfy

Hosted by Marketfy  Get Benzinga's News Delivered Free Zing Talk: Daily Top Stories

Get Benzinga's News Delivered Free Zing Talk: Daily Top Stories

Bloomberg via Getty Images Software maker Adobe revealed today that had been hacked back in August, and that the cyber criminals made off with a huge chunk of data about 2.9 million of its users, including encrypted credit card data, as well as source code for the company's products. Adobe, best known for its Photoshop and Acrobat applications, didn't notice the breach until an outside security expert spotted some of their data on a server that had been used by hackers. • House Speaker John Boehner has reportedly told Republicans that he will not let the U.S. default, and he's allegedly willing to ignore the so-called "Hastert rule" to increase the debt ceiling if he has to. Boehner's now hoping to swing a combined deal that passes a budget bill and raises the debt limit. • Could one man -- besides John Boehner -- resolve our debt limit problem? Maybe: For a brief time, an East Texas man was the world's richest person, with a bank balance of more than $4 trillion. Naturally, this bank error in his favor was rapidly remedied. • Speaking of the debt ceiling -- and a lot of people are speaking about the debt ceiling -- you'll hear over and over from politicians and pundits that "The United States has never defaulted on its debts." Not true. This is not our first trip down Default Lane. • Ford (F) sold just 2,049 fewer vehicles in the U.S. than General Motors (GM) in September, putting it within a hair of beating the market leader. It's only outsold GM four times in the past two decades, but it may just pull it off again in October. • In today's economy, a lot of people are working more than one job to make ends meet. Jamie Dimon, the CEO and chairman of JPMorgan Chase (JPM), is moving in the other direction: He has given up the job of chairman of its main bank subsidiary, JPMorgan Chase Bank. Nothing to see here, just getting into compliance with a new internal policy on employees holding multiple roles.

Bloomberg via Getty Images Software maker Adobe revealed today that had been hacked back in August, and that the cyber criminals made off with a huge chunk of data about 2.9 million of its users, including encrypted credit card data, as well as source code for the company's products. Adobe, best known for its Photoshop and Acrobat applications, didn't notice the breach until an outside security expert spotted some of their data on a server that had been used by hackers. • House Speaker John Boehner has reportedly told Republicans that he will not let the U.S. default, and he's allegedly willing to ignore the so-called "Hastert rule" to increase the debt ceiling if he has to. Boehner's now hoping to swing a combined deal that passes a budget bill and raises the debt limit. • Could one man -- besides John Boehner -- resolve our debt limit problem? Maybe: For a brief time, an East Texas man was the world's richest person, with a bank balance of more than $4 trillion. Naturally, this bank error in his favor was rapidly remedied. • Speaking of the debt ceiling -- and a lot of people are speaking about the debt ceiling -- you'll hear over and over from politicians and pundits that "The United States has never defaulted on its debts." Not true. This is not our first trip down Default Lane. • Ford (F) sold just 2,049 fewer vehicles in the U.S. than General Motors (GM) in September, putting it within a hair of beating the market leader. It's only outsold GM four times in the past two decades, but it may just pull it off again in October. • In today's economy, a lot of people are working more than one job to make ends meet. Jamie Dimon, the CEO and chairman of JPMorgan Chase (JPM), is moving in the other direction: He has given up the job of chairman of its main bank subsidiary, JPMorgan Chase Bank. Nothing to see here, just getting into compliance with a new internal policy on employees holding multiple roles. [ Enlarge Image ]

[ Enlarge Image ]