Since 2007, we had an undervalued market, as measured by the standard averages. I no longer think this is the case. Fortunately, however, we are not buying based on averages, notes Russ Kaplan, editor of Heartland Advisor.

We are buying individual companies and there are still many which we think qualify as buy candidates. Because of this, I do not recommend changing strategies. We do, however, see the need to be much more selective.

I first recommended Deere & Company (DE) in 1998. Since then the price has more than doubled and the dividend has been above average. So why buy it now?

I look for a price which is below intrinsic value (how much the company is really worth). This is the case with Deere, since its intrinsic value has grown more than the price at which the stock is now trading.

Back in 1837, when the Industrial Revolution was starting, and agriculture was moving beyond the horse and wooden plow, Deere was established. Their first invention and product was the steel plow, which ensured improvement for planting deeper rows.

5 Best Undervalued Stocks To Buy Right Now: Dollar Tree Inc.(DLTR)

Dollar Tree, Inc. operates discount variety stores in the United States and Canada. Its stores offer merchandise primarily at the fixed price of $1.00. The company operates its stores under the names of Dollar Tree, Deal$, Dollar Tree Deal$, Dollar Giant, and Dollar Bills. Its stores offer consumable merchandise, including candy and food, and health and beauty care, as well as household consumables, such as paper, plastics, household chemicals, in select stores, and frozen and refrigerated food; variety merchandise, which includes toys, durable housewares, gifts, party goods, greeting cards, softlines, and other items; and seasonal goods, such as Easter, Halloween, and Christmas merchandise. As of April 30, 2011, it operated 4,089 stores in 48 states and the District of Columbia, as well as 88 stores in Canada. The company was founded in 1986 and is based in Chesapeake, Virginia.

Advisors' Opinion:- [By Paul Ausick]

Big Earnings Movers: Target Corp. (NYSE: TGT) is down 3.5% at $64.19. Sears Holdings Corp. (NASDAQ: SHLD) is down 2.9% at $59.93 on a wider loss and tepid outlook. Green Mountain Coffee Roasters Inc. (NASDAQ: GMCR) is up 14.1% at $70.57 indicating that investors liked the results posted after markets closed on Wednesday. Dollar Tree Inc. (NASDAQ: DLTR) is down 4.5% at $56.28. Abercrombie & Fitch Inc. (NYSE: ANF) is down 0.1% at $34.97.

- [By Rich Duprey]

Deep discounter Dollar Tree (NASDAQ: DLTR ) announced today that its current chief operating officer, Gary Philbin, will now also carry the title of president, a position previously held by company CEO Bob Sasser.

- [By Dan Moskowitz]

The shiniest dollar

Many investors and analysts like to debate which dollar store offers the best investment opportunity. The truth is that Dollar General, Dollar Tree Stores (NASDAQ: DLTR ) , and Family Dollar Stores (NYSE: FDO ) are all likely to be quality long-term investments.

5 Best Undervalued Stocks To Buy Right Now: Tupperware Corporation(TUP)

Tupperware Brands Corporation operates as a direct seller of various products across a range of brands and categories through an independent sales force. The company engages in the manufacture and sale of kitchen and home products, and beauty and personal care products. It offers preparation, storage, and serving solutions for the kitchen and home, as well as kitchen cookware and tools, children?s educational toys, microwave products, and gifts under the Tupperware brand name primarily in Europe, Africa, the Middle East, the Asia Pacific, and North America. The company provides beauty and personal care products, which include skin care products, cosmetics, bath and body care, toiletries, fragrances, nutritional products, apparel, and related products principally in Mexico, South Africa, the Philippines, Australia, and Uruguay. It offers beauty and personal care products under the Armand Dupree, Avroy Shlain, BeautiControl, Fuller, NaturCare, Nutrimetics, Nuvo, and Swissgar de brand names. The company sells its Tupperware products directly to distributors, directors, managers, and dealers; and beauty products primarily through consultants and directors. As of December 26, 2009, the Tupperware distribution system had approximately 1,800 distributors, 61,300 managers, and 1.3 million dealers; and the sales force representing the Beauty businesses approximately 1.1 million. The company was formerly known as Tupperware Corporation and changed its name to Tupperware Brands Corporation in December 2005. The company was founded in 1996 and is headquartered in Orlando, Florida.

Advisors' Opinion:- [By Brian Pacampara]

Based on the aggregated intelligence of 180,000-plus investors participating in Motley Fool CAPS, the Fool's free investing community, household products company Tupperware Brands (NYSE: TUP ) has earned a coveted five-star ranking.

- [By Eric Volkman]

Tupperware Brands (NYSE: TUP ) is reaching into its corporate bowl for a fresh payout to shareholders. The company has declared a quarterly dividend of $0.62 per share. This will be paid on July 8 to stockholders of record as of June 19. That amount matches the firm's previous distribution, which was paid in early April. Prior to that, Tupperware Brands was rather less generous, handing out $0.36 per share.

- [By Monica Gerson]

Tupperware Brands (NYSE: TUP) is expected to report its Q3 earnings at $1.03 per share on revenue of $623.34 million.

Varian Medical Systems (NYSE: VAR) is projected to post its Q4 earnings at $1.12 per share on revenue of $779.02 million.

10 Best Cheap Stocks To Own For 2014: Schlumberger N.V.(SLB)

Schlumberger Limited, together with its subsidiaries, supplies technology, integrated project management, and information solutions to the oil and gas exploration and production industries worldwide. The company?s Oilfield Services segment provides exploration and production services; wireline technology that offers open-hole and cased-hole services; supplies engineering support, directional-drilling, measurement-while-drilling, and logging-while-drilling services; and testing services. This segment also offers well services; supplies well completion services and equipment; artificial lift; data and consulting services; geo services; and information solutions, such as consulting, software, information management system, and IT infrastructure services that support oil and gas industry. Its WesternGeco segment provides reservoir imaging, monitoring, and development services; and operates data processing centers and multiclient seismic library. This segment also offers variou s services include 3D and time-lapse (4D) seismic surveys to multi-component surveys for delineating prospects and reservoir management. The company?s M-I SWACO segment supplies drilling fluid systems to improve drilling performance; fluid systems and specialty tools to optimize wellbore productivity; production technology solutions to maximize production rates; and environmental solutions that manages waste volumes generated in drilling and production operations. Its Smith Oilfield segment designs, manufactures, and markets drill bits and borehole enlargement tools; and supplies drilling tools and services, tubular, completion services, and other related downhole solutions. The company?s Distribution segment markets pipes, valves, and fittings, as well as mill, safety, and other maintenance products. This segment also provides warehouse management, vendor integration, and inventory management services. Schlumberger Limited was founded in 1927 and is based in Houston, Texas.

Advisors' Opinion:- [By Maxx Chatsko]

Industry ties

The company's management team has deep roots in the energy industry, specifically in oilfield services. President and CEO Gary Kolstad spent 21 years at Schlumberger (NYSE: SLB ) before joining CARBO, while Don Conkle, vice president of marketing and sales, spent 26 years at the same firm. No wonder Schlumberger is one of the top two customers for this proppant manufacturer. Both served in various roles at the company and are well versed in the ebbs and flows of the energy industry, which should serve investors well through the rocky environment of falling natural gas drilling activity.

5 Best Undervalued Stocks To Buy Right Now: Caterpillar Inc.(CAT)

Caterpillar Inc. manufactures and sells construction and mining equipment, diesel and natural gas engines, industrial gas turbines, and diesel-electric locomotives worldwide. It operates through three lines of businesses: Machinery, Engines, and Financial Products. The Machinery business offers construction, mining, and forestry machinery, including track and wheel tractors, track and wheel loaders, pipelayers, motor graders, wheel tractor-scrapers, track and wheel excavators, backhoe loaders, log skidders, log loaders, off-highway trucks, articulated trucks, paving products, skid steer loaders, underground mining equipment, tunnel boring equipment, and related parts. It also manufactures diesel-electric locomotives; and manufactures and services rail-related products and logistics services for other companies. The Engines business provides diesel, heavy fuel, and natural gas reciprocating engines for Caterpillar machinery, electric power generation systems, marine, petrol eum, construction, industrial, agricultural, and other applications. It offers industrial turbines and turbine-related services for oil and gas, and power generation applications. This business also remanufactures Caterpillar engines, machines, and engine components; and offers remanufacturing services for other companies. The Financial Products business provides retail and wholesale financing alternatives for Caterpillar machinery and engines, solar gas turbines, and other equipment and marine vessels, as well as offers loans and various forms of insurance to customers and dealers. It also offers financing for vehicles, power generation facilities, and marine vessels. The company markets its products directly, as well as through its distribution centers, dealers, and distributors. It was formerly known as Caterpillar Tractor Co. and changed its name to Caterpillar Inc. in 1986. Caterpillar Inc. was founded in 1925 and is headquartered in Peoria, Illinois.

Advisors' Opinion:- [By Anders Bylund]

Other anomalies include Caterpillar (NYSE: CAT ) falling 7% on slow investments in global infrastructure construction. Thanks to the CAT's large share price, this move dragged the Dow down by 47 points. For a sense of scale, that's more than the 40 points that Cisco Systems (NASDAQ: CSCO ) brought to the table -- with a huge 27% move to the upside. Cisco's long-term vision of dominance across the data center is finally coming together and the market is responding strongly. But like I said, this 27% jump makes less of a difference to the Dow than Caterpillar's much smaller 7% move.

- [By Alex Planes]

Founded in 1925, Caterpillar (NYSE: CAT ) is the world's largest manufacturer of construction and mining equipment, and ranked among the top 50 Fortune 500 companies in the U.S. for 2012. Caterpillar is also a component of both the Dow. Headquartered in Peoria, Ill., Caterpillar traces its roots from the merger of the Holt Manufacturing Company and the C.L. Best Tractor Company. The company has grown through a number of acquisitions over the past decade, including Shin Caterpillar Mitsubishi in 2008, Caterpillar Xuzhou and MWM Holding in 2010 and Bucyrus International in 2011. Caterpillar heavy machinery is as common at construction and excavation sites as Boeing's jets are at airports, which makes this a classic battle of land versus air.

- [By Taylor Muckerman and Joel South]

On the heels of a better-than-expected release from Peabody Energy (NYSE: BTU ) and expectations from Caterpillar (NYSE: CAT ) that coal prices could rise somewhat in 2013, both businesses might be set to succeed in tandem. The price of natural gas has been climbing rapidly to start 2013, which should help coal regain some traction. And its East Coast export facility continues to provide access to the demanding European market. In the following video, Taylor Muckerman expects some positive news on Thursday and thinks you should, too.

Popular Posts: 9 Biotechnology Stocks to Buy Now17 Oil and Gas Stocks to Sell Now10 Worst “Strong Sell” Stocks This Week — EGO WLT RBY and more Recent Posts: 5 Best Sectors to Watch This Week 4 Capital Markets Stocks to Sell Now 3 Medical Devices Stocks to Sell Now View All Posts

Popular Posts: 9 Biotechnology Stocks to Buy Now17 Oil and Gas Stocks to Sell Now10 Worst “Strong Sell” Stocks This Week — EGO WLT RBY and more Recent Posts: 5 Best Sectors to Watch This Week 4 Capital Markets Stocks to Sell Now 3 Medical Devices Stocks to Sell Now View All Posts

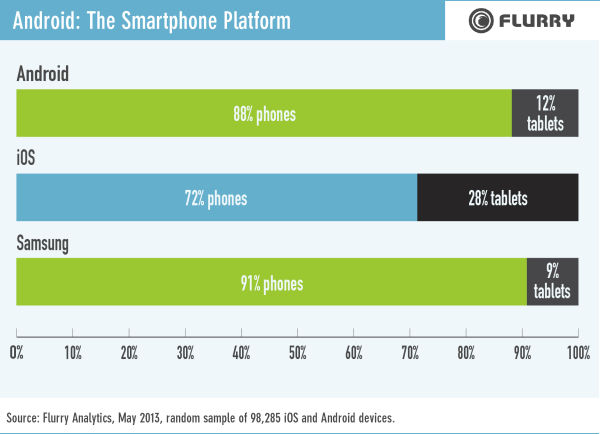

Source: Courtesy Flurry

Source: Courtesy Flurry Alamy Politics aside, Hillary Clinton was right: For most of human history, it usually took a village (or a tribe) of people to raise a child. Humans are social creatures: Though moms and -- to a lesser extent -- dads shouldered the major tasks of child-rearing, the support of the community played a huge role. Meals were cooked, kids were looked after, and social groups helped ensure the safe upbringing of the young. Today, that same societal structure isn't anywhere near as prevalent. In its place are long waiting lists and sky-high costs associated with putting a child in day care. How expensive has this gotten? If you lived in Washington, D.C., in 2011, putting your infant in a child care center would have cost $388 per week -- or more than $20,000 for a full year. Of course, I'm cherry-picking one of the most expensive locales, but it highlights a nationwide trend. In fact, in every region of the country except for the West, a family with two children in child care spent more for their kids to be looked after than they did on all housing costs combined. If you're expecting, or already have children, here are some key trends to keep in mind when deciding what to do when it comes to looking after your kids. Location, Location, Location This is the mantra of just about every real estate agent, but the same could be said of child care providers. For instance, full-time child care for an infant in Mississippi averaged $4,600 per year in 2011, but was $15,000 in Massachusetts. But the difference in absolute dollars doesn't mean much when you consider that the average salary in Massachusetts is higher than what it is in Mississippi. Instead, here's a look at the five least and most expensive states to have an infant in center-based care, as a percentage of median family income.

Alamy Politics aside, Hillary Clinton was right: For most of human history, it usually took a village (or a tribe) of people to raise a child. Humans are social creatures: Though moms and -- to a lesser extent -- dads shouldered the major tasks of child-rearing, the support of the community played a huge role. Meals were cooked, kids were looked after, and social groups helped ensure the safe upbringing of the young. Today, that same societal structure isn't anywhere near as prevalent. In its place are long waiting lists and sky-high costs associated with putting a child in day care. How expensive has this gotten? If you lived in Washington, D.C., in 2011, putting your infant in a child care center would have cost $388 per week -- or more than $20,000 for a full year. Of course, I'm cherry-picking one of the most expensive locales, but it highlights a nationwide trend. In fact, in every region of the country except for the West, a family with two children in child care spent more for their kids to be looked after than they did on all housing costs combined. If you're expecting, or already have children, here are some key trends to keep in mind when deciding what to do when it comes to looking after your kids. Location, Location, Location This is the mantra of just about every real estate agent, but the same could be said of child care providers. For instance, full-time child care for an infant in Mississippi averaged $4,600 per year in 2011, but was $15,000 in Massachusetts. But the difference in absolute dollars doesn't mean much when you consider that the average salary in Massachusetts is higher than what it is in Mississippi. Instead, here's a look at the five least and most expensive states to have an infant in center-based care, as a percentage of median family income.  Even within states, however, there are big differences. And no variable seems to be more important than -- you guessed it -- location. But this time, instead of talking about different states, we're referring to the difference between living in an urban or suburban community (defined as near a city center of at least 50,000) and a rural one. The most extreme example would be in Oregon, where the cost to put your infant in a child care center in an urban area is more than as expensive as it is in a rural area. But Oregon isn't alone: How Much More Expensive Is Urban Care vs. Rural Care?

Even within states, however, there are big differences. And no variable seems to be more important than -- you guessed it -- location. But this time, instead of talking about different states, we're referring to the difference between living in an urban or suburban community (defined as near a city center of at least 50,000) and a rural one. The most extreme example would be in Oregon, where the cost to put your infant in a child care center in an urban area is more than as expensive as it is in a rural area. But Oregon isn't alone: How Much More Expensive Is Urban Care vs. Rural Care?  Is It a Better Option to Quit Your Job and Stay at Home? When confronted with such costs -- and endless waiting lists -- many parents are faced with the difficult decision of whether to continue working or to take a few years off to care for their children themselves. Of course, finances alone aren't the only consideration; for many people, their work is an intrinsically rewarding experience that goes beyond just earning a paycheck. But because one's approach to their work varies from individual to individual, let's just focus on the dollars and cents of such a decision. One very important matter to be aware of is a federal tax credit available to families who have to pay for child care. The credit is good for up to 35 percent of your child care bill with a limit of $3,000 for one child and $6,000 for two or more children. Let's take the most average state from our data set -- Iowa -- and see when it makes more financial sense to stay at home.

Is It a Better Option to Quit Your Job and Stay at Home? When confronted with such costs -- and endless waiting lists -- many parents are faced with the difficult decision of whether to continue working or to take a few years off to care for their children themselves. Of course, finances alone aren't the only consideration; for many people, their work is an intrinsically rewarding experience that goes beyond just earning a paycheck. But because one's approach to their work varies from individual to individual, let's just focus on the dollars and cents of such a decision. One very important matter to be aware of is a federal tax credit available to families who have to pay for child care. The credit is good for up to 35 percent of your child care bill with a limit of $3,000 for one child and $6,000 for two or more children. Let's take the most average state from our data set -- Iowa -- and see when it makes more financial sense to stay at home.