LANSING, Mich. — The car, like the brand, like the plant, is a collective memory.

Ten years ago Tuesday, a dark cherry Alero sedan drove off the line at what was then General Motors Corp.'s Lansing Car Assembly plant. It was the last Oldsmobile, the sendoff to a nameplate founded here more than a century ago by the son of a machinist.

It was a bitter farewell, but one tempered with the promise of new auto jobs here for years to come in the form of new plants making other GM brands. Oldsmobile, a pioneer in the business of making cars, had watched its sales slump and its models become ordinary. They simply weren't distinct enough to stand out from GM's other car lines or draw younger buyers.

Many criticized the Detroit automaker's decision to kill the Oldsmobile division and thought dropping other brands made more sense. But GM had been forging ahead with its decision long before the shutdown.

Lansing had been synonymous with Oldsmobile since 1897, when Ransom Eli Olds founded the Olds Motor Vehicle Co. after experimenting with horseless carriages in his father's River Street shop. Olds' original company would become GM's second brand, after Buick, in 1908.

2004: Last Oldsmobile rolls off the line

2000: GM to phase out Oldsmobile

Oldsmobile lives these days in Boomers' garages, dated photographs, curated museums and the stories of old-timers who still say, years after they retired and long after the plants came down, that they worked for Oldsmobile — not GM.

"The name is fading. You don't see Oldsmobiles anymore. And in the town that created them, you're getting generations now who have no frame of reference for it," said Diana Tarpoff, an East Lansing, Mich., resident and Olds' great-granddaughter. "You're going to have a whole new generation very soon who has no memory of it."

Diana Tarpoff of East Lansing, Mich., is one of R.E. Olds' great-granddaughters and president of the R.E. Olds Foundation, which is celebrating its 100th year.(Photo: Greg DeRuiter, Lansing (Mich.) State Journal)

On a recent weekday afternoon, Steve Delaney flipped through historical Oldsmobile photos in several three-ring binders at a table in a mostly empty Harry's Place, a neighborhood bar and restaurant across the street from GM's old Fisher Body plant.

Out the window, the grassy remnants of the demolished plant stand empty.

"Growing up here, I never intended to work for Oldsmobile. I didn't want to work at the factory," said Delaney, now an electrician at GM's Lansing Delta Township assembly plant and a United Auto Workers Local 602 leader.

His classmates' parents were dentists or lawyers. His father was a pipefitter but not for an automaker. Delaney assumed he would go to college, study business administration and join the professional ranks. But in 1971 after a year at Central Michigan University, he had used up the money he'd saved for school.

He applied to auto manufacturers and suppliers, figuring he would work for a year to earn enough to return to classes. But Oldsmobile called with a job, and he stayed.

"You could graduate from high school, hire into Oldsmobile and walk into the middle class overnight," said Delaney, who would land an apprenticeship as a skilled tradesman. "I'm probably better off now than if I had gone back to school for three more years and come out as a teacher."

Today, an auto job still is a decent way to earn a living, even at GM's lower entry-level wage, he said. But it doesn't promise the same financial advantages Oldsmobile once did.

It took a lot for people here to get the mindset to get over the loss of Oldsmobile. It was the end of an era.

-

Oldsmobile's demise was solidified during this past decade as GM razed Fisher ! Body and ! several other outdated local plants a few years before the 2009 bankruptcy.

Old-timers thought the end of Oldsmobile spelled death for Lansing as an auto town.

"There are young kids who come into where we're working now and their dad(s) worked for Oldsmobile," said Alex Hernandez, a third-generation GM worker who, along with his father and grandfather, worked at Fisher Body. "It's like working in a coal town or a steel mill town.

"There would be no Lansing without Oldsmobile," Hernandez said. "He had a dream and he did it in this town."

He, of course, is Olds himself, who quit his stake in the company he founded before it joined what was then was a fledgling General Motors. GM adopted the Oldsmobile name and folded the company and its Buick line into what would become a collection of carmaking names with pioneering roots — Cadillac, Chevrolet and Pontiac among them.

Oldsmobile rode high through the 1980s, selling more than 1 million vehicles per year. Some of its cars remain among the most recognizable in the U.S. auto industry — the Curved Dash Olds, Cutlass, Cutlass Supreme and 442, to name a few.

But Olds saw its sales tumble through the 1990s to just a few hundred thousand.

Paul Armbrustmacher polishes the insignia of a finished 1999 Oldsmobile Alero for display at the 1998 Detroit Auto Show.(Photo: Rod Sanford, Lansing (Mich.) State Journal)

By its centennial mark in 1997, some analysts were predicting the brand's image problems could be insurmountable. A late-1980s ad campaign meant to lure younger buyers by pitching the cars as "not your father's Oldsmobile" would backfire. The stodgy image only deepened.

Delaney and Hernandez said the line suffered from design problems: I! ts cars w! ere indistinct compared with GM's other nameplates. Oldsmobile was too "cookie-cutter," Delaney said — essentially a clone of other GM cars but with a different name.

The New York Times, in a review of the Alero nearly two months after Oldsmobile had ended, was more blunt.

"Not a terribly bad car nor an especially good one, the Alero's white-bread mediocrity is typical of the small to midsize cars that Detroit has churned out for years," it wrote. "The Alero is, in fact, a virtual twin of the Pontiac Grand Am. Both are transportation devices, cars for people who don't like cars very much."

By 2000, GM said it was ready to close the door on Oldsmobile. Other divisions — Pontiac and Saturn — would follow. Still others, such as Saab and Hummer, would be sold off.

GM now has four nameplates, all of which have at least one vehicle built here: Buick, Cadillac, Chevrolet and GMC.

"Part of it was just simple math," said Mark Phelan, a Detroit Free Press auto critic. "GM had about 50% more brands than it needed.

Oldsmobile owners line up in 1998 at Oldsmobile headquarters in Lansing, Mich., for a car show.(Photo: Rod Sanford, Lansing (Mich.) State Journal)

"They couldn't come up with distinctive visions for them. It became hard to say what was the difference between Oldsmobile and Buick," Phelan said. "Oldsmobile became associated with old stodgy vehicles because GM didn't have the money to invest in really good new product lines, contemporary product lines, for all of the brands it had."

On April 29, 2004, that dark cherry Alero left the line with Lansing Car Assembly's two most senior employees behind the wheel. Workers were allowed to bring their own cameras into the plant and thousands of pe! ople sign! ed their names underneath the hood.

That Alero was on display at the R.E. Olds Transportation Museum here for several years. It now has a permanent residence in GM's Heritage Center in Sterling Heights, Mich.

"Their goal was to build the vehicle with the same level of quality that the first one off the line came with — a lot of, 'Let's make this one the best,'" said GM spokeswoman Kim Carpenter, who worked in Lansing's plants at the time and now manages East Coast communications in New York.

"In my opinion, they identified with being world-class automakers," Carpenter said. "For them, the brand was vitally important, but they knew other opportunities would come."

"The post-mortems for this venerable car company may someday reveal that GM tried to fit Oldsmobile's round peg into GM's square hole; and the fit, not the product, was the problem. Or, perhaps, the name and the product line simply could not keep pace with the changing tastes of American drivers. We only know this final chapter, while not wholly unsurprising, is poignant. Oldsmobile's imminent demise is like watching an old friend die slowly. And that hurts."

— Lansing State Journal editorial, Dec. 13, 2000

"It took a lot for people here to get the mindset to get over the loss of Oldsmobile," Lansing Mayor Virg Bernero said. "It was the end of an era. The end of Oldsmobile wasn't the end of GM."

Employment never will approach the more than 20,000 people who worked at GM plants in the 1970s, he said, but that shouldn't be the sole indicator of the health of the region's manufacturing sector.

The $4 million R.E. Olds Foundation, which Olds started 100 years ago to give back some of the earnings from his inventions, donates close to $200,000 annually in grants to community organizations that serve children and families, animal welfare and conservation, among other things.

The museum in Lansing that bears his name is full of photos and vehicles, including an original Curved Dash Oldsm! obile on ! loan from Michigan State University. But its director says it became harder to raise funds once the cars disappeared from the road.

Debbie Stephens, one of Olds' great-granddaughters, said she continues to find photos and Olds memorabilia in boxes her mother left after she died two years ago. She plans to visit Lansing this summer to present some of them.

Since Oldsmobile production stopped, "it really hasn't been in the limelight the way I feel it should be and my family feels it should be," said Stephens, 61, who lives in the Columbus, Ohio, suburb of Dublin. "We all have a common purpose: To keep the automotive history alive because it, obviously, it affects every single person everywhere."

Workers are doing their best to preserve it. The mission statement at GM's Lansing Delta Township plant begins with the words: "Building on our heritage."

It was drafted April 28, 2004, the day before the Alero's last day.

"Everyone knows what that heritage is," said Delaney, who works at the plant. "That pride and workmanship that started with Oldsmobile is still here."

Twitter (TWTR) is 45% off highs set in December, and also touched new "bear market" lows this morning. Yet bulls have actually been increasing their level of bullishness in recent weeks -- weighing in today at 73%!

Twitter (TWTR) is 45% off highs set in December, and also touched new "bear market" lows this morning. Yet bulls have actually been increasing their level of bullishness in recent weeks -- weighing in today at 73%!

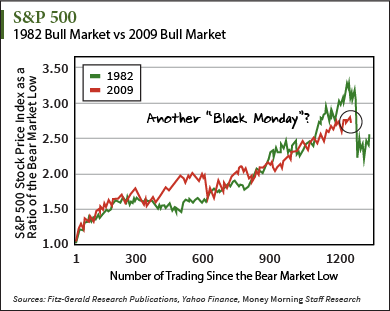

Much has been written about John Q. Public and his general apathy towards the stock market since the 2008 to 2009 financial wipeout. This obviously doesn't jibe with stock market indices more than doubling during the five years since then. On the flip side, we're seeing individual stocks maintaining rather bullish sentiment scores, despite suffering extremely painful losses. Who's right? Is everyone wrong? Have we all lost our minds? Follow me on StockTwits: @chicagosean At the time of publication, the author held no positions in any of the stocks mentioned. This article represents the opinion of a contributor and not necessarily that of TheStreet or its editorial staff.

Much has been written about John Q. Public and his general apathy towards the stock market since the 2008 to 2009 financial wipeout. This obviously doesn't jibe with stock market indices more than doubling during the five years since then. On the flip side, we're seeing individual stocks maintaining rather bullish sentiment scores, despite suffering extremely painful losses. Who's right? Is everyone wrong? Have we all lost our minds? Follow me on StockTwits: @chicagosean At the time of publication, the author held no positions in any of the stocks mentioned. This article represents the opinion of a contributor and not necessarily that of TheStreet or its editorial staff.

The second rule is that only the uninformed focus exclusively on if the company beat or missed earnings expectations. Earnings results are just that, results that report what happened BEFORE. But the market focuses on what WILL happen. Big-money Wall Street fund managers -- the whales that move a stock price -- review last quarter's results only up to the point the data aids in predicting future expectations. While many are satisfied if Under Armour, Amazon and Microsoft outperform their previous quarter, fund managers closely scrutinize margin trends, forward guidance, growth rates (or lack thereof), competitive influences, management changes, cash flow, dilution and other factors. They are painting a picture of the next quarter, the next year and beyond. The third rule is that one quarter doesn't matter. That's a hard one for many to understand in the heat of battle. Patterns can't be found in sample sizes of one. Fund managers plug a given company's results into spreadsheets and compare the results with previous quarters to find hidden patterns and trends.

The second rule is that only the uninformed focus exclusively on if the company beat or missed earnings expectations. Earnings results are just that, results that report what happened BEFORE. But the market focuses on what WILL happen. Big-money Wall Street fund managers -- the whales that move a stock price -- review last quarter's results only up to the point the data aids in predicting future expectations. While many are satisfied if Under Armour, Amazon and Microsoft outperform their previous quarter, fund managers closely scrutinize margin trends, forward guidance, growth rates (or lack thereof), competitive influences, management changes, cash flow, dilution and other factors. They are painting a picture of the next quarter, the next year and beyond. The third rule is that one quarter doesn't matter. That's a hard one for many to understand in the heat of battle. Patterns can't be found in sample sizes of one. Fund managers plug a given company's results into spreadsheets and compare the results with previous quarters to find hidden patterns and trends.  Craig Warga/Bloomberg via Getty Images U.S. consumers felt less confident about their finances last month, attributable in part to the looming April 15 tax deadline, a new survey finds. The Consumer Bankers Association and AOL (AOL) monthly Finance Optimism Index fell 3.6 points to -6.2, the organizations said Thursday. An index value below zero indicates that greater number of those who responded to the poll felt pessimistic than optimistic about their personal finances. Results of the survey suggest April's impending federal income tax deadline combined with other factors, including sluggish job growth and swiftly rising food prices, meant more Americans overall were feeling their budgets squeezed in March. The CBA and AOL Finance Optimism Index tracks optimism through agreement with four statements in a survey: I am optimistic about my personal financial future. I am worried about my current financial situation. The news I've been hearing in the past few weeks about Americans' personal finances has been generally positive. I am worried that the current economic and political situation is going to affect my personal finances. The poll results were in line with another measure of consumer confidence in the U.S. economy -- the final March survey of consumer sentiment by the University of Michigan, which showed consumers trimming spending as their faith in a growing economy waned. Another measure, however, showed Americans felt more upbeat. The Conference Board last month said its index of consumer attitudes rose to its highest level since January 2008. Still, while the Conference Board survey found consumers were more upbeat about the overall economy and employment prospects, findings suggested that Americans were concerned about their ability to earn more money and rising prices.

Craig Warga/Bloomberg via Getty Images U.S. consumers felt less confident about their finances last month, attributable in part to the looming April 15 tax deadline, a new survey finds. The Consumer Bankers Association and AOL (AOL) monthly Finance Optimism Index fell 3.6 points to -6.2, the organizations said Thursday. An index value below zero indicates that greater number of those who responded to the poll felt pessimistic than optimistic about their personal finances. Results of the survey suggest April's impending federal income tax deadline combined with other factors, including sluggish job growth and swiftly rising food prices, meant more Americans overall were feeling their budgets squeezed in March. The CBA and AOL Finance Optimism Index tracks optimism through agreement with four statements in a survey: I am optimistic about my personal financial future. I am worried about my current financial situation. The news I've been hearing in the past few weeks about Americans' personal finances has been generally positive. I am worried that the current economic and political situation is going to affect my personal finances. The poll results were in line with another measure of consumer confidence in the U.S. economy -- the final March survey of consumer sentiment by the University of Michigan, which showed consumers trimming spending as their faith in a growing economy waned. Another measure, however, showed Americans felt more upbeat. The Conference Board last month said its index of consumer attitudes rose to its highest level since January 2008. Still, while the Conference Board survey found consumers were more upbeat about the overall economy and employment prospects, findings suggested that Americans were concerned about their ability to earn more money and rising prices.

Getty Images The deadline for filing your taxes was April 15, but tax scammers have no deadline. In a quest for personal information and money even after filing deadlines, scammers often impersonate the Internal Revenue Service. "The IRS encourages taxpayers to be vigilant year round against phone and email scams that use the IRS as a lure," the IRS said in a statement emailed to CNBC.com. "These scams won't likely end with the filing season so the IRS urges everyone to remain on guard," the IRS said in the email. Can You Trust Caller ID? Since October, the IRS has been warning Americans about a sophisticated phone scam that remains pervasive and frequently targets immigrants. The scam has cost the victims more than $1 million, and there have been roughly 20,000 reports of the scam, according to a Treasury Inspector General for Tax Administration press release. The scam begins with a phone call claiming to be from the IRS. Usually the scammer will say either the call recipient is entitled to a big refund, or they owe money that must be paid immediately. If the recipient refuses to pay, the scamming caller often becomes hostile and threatens jail time or a revocation of the individual's drivers' license. The phone scam is so sophisticated that the scammers are able to outsmart caller ID technology so that the IRS's number appears. Adding to the appearance of legitimacy, the scammers will offer fake IRS badge numbers and often know the last four digits of the victim's Social Security number. When receiving one of these calls, "people have to step back and take a deep breath," said Laura Iwan, senior vice president of programs for the Center for Internet Security, a nonprofit that focuses on cybersecurity. She suggests targeted individuals immediately contact the IRS to see if the original call was legitimate. Other signs the call may be from a scammer include the caller asking for payment using a pre-paid debit card or wire transfer, or asking for a credit card number. The IRS will not ask for this type of payment, nor will they ask for your credit card number over the phone. Additionally, the IRS's primary correspondence method is through the U.S. Postal Service. Watch Out for Phishing Emails While the phone scams are a new threat, phishing emails continue to be a pervasive scam tactic. These phishing emails sometimes contain links to websites that are infected with malware, and purport to be from the IRS and try to convince you to volunteer your personal information. "We definitely see more phishing, often with a malware component [after April 15]. The messages may pretend to be from the IRS, or one of the popular companies people tend to use for e-filing their taxes," said Roel Schouwenberg, principal security researcher at Kaspersky Lab in an email to CNBC.com. Like the scam phone calls, these phishing emails will either promise the taxpayer a refund or claim the taxpayer owes money and usually threatens dire consequences if not paid, said Iwan of the Center for Internet Security. The IRS will not initiate contact with taxpayers by email or any other form of electronic communication. If you receive an email claiming to be from the IRS, you should avoid clicking on any links or opening any attachment. You should also report the email to the IRS by forwarding it to phishing@irs.gov. Be Careful Where You Store Your Taxes More than 90 percent of Americans now electronically file their taxes, according to the IRS. While computers have expedited tax return preparation, security experts warn they are a risky place to store your personal tax data. "Tax returns are a treasure trove. They contain everything someone needs to steal yours and your spouse's identity. They can be easily stolen," Schouwenberg said. Iwan suggests once you file, store your taxes on an external hard drive or flash drive. You should also make sure you have up-to-date anti-virus, anti-malware, and firewall software. If you believe you are the victim of identity theft, contact the IRS Identity Protection Specialized Unit at 800-908-4490, extension 245.

Getty Images The deadline for filing your taxes was April 15, but tax scammers have no deadline. In a quest for personal information and money even after filing deadlines, scammers often impersonate the Internal Revenue Service. "The IRS encourages taxpayers to be vigilant year round against phone and email scams that use the IRS as a lure," the IRS said in a statement emailed to CNBC.com. "These scams won't likely end with the filing season so the IRS urges everyone to remain on guard," the IRS said in the email. Can You Trust Caller ID? Since October, the IRS has been warning Americans about a sophisticated phone scam that remains pervasive and frequently targets immigrants. The scam has cost the victims more than $1 million, and there have been roughly 20,000 reports of the scam, according to a Treasury Inspector General for Tax Administration press release. The scam begins with a phone call claiming to be from the IRS. Usually the scammer will say either the call recipient is entitled to a big refund, or they owe money that must be paid immediately. If the recipient refuses to pay, the scamming caller often becomes hostile and threatens jail time or a revocation of the individual's drivers' license. The phone scam is so sophisticated that the scammers are able to outsmart caller ID technology so that the IRS's number appears. Adding to the appearance of legitimacy, the scammers will offer fake IRS badge numbers and often know the last four digits of the victim's Social Security number. When receiving one of these calls, "people have to step back and take a deep breath," said Laura Iwan, senior vice president of programs for the Center for Internet Security, a nonprofit that focuses on cybersecurity. She suggests targeted individuals immediately contact the IRS to see if the original call was legitimate. Other signs the call may be from a scammer include the caller asking for payment using a pre-paid debit card or wire transfer, or asking for a credit card number. The IRS will not ask for this type of payment, nor will they ask for your credit card number over the phone. Additionally, the IRS's primary correspondence method is through the U.S. Postal Service. Watch Out for Phishing Emails While the phone scams are a new threat, phishing emails continue to be a pervasive scam tactic. These phishing emails sometimes contain links to websites that are infected with malware, and purport to be from the IRS and try to convince you to volunteer your personal information. "We definitely see more phishing, often with a malware component [after April 15]. The messages may pretend to be from the IRS, or one of the popular companies people tend to use for e-filing their taxes," said Roel Schouwenberg, principal security researcher at Kaspersky Lab in an email to CNBC.com. Like the scam phone calls, these phishing emails will either promise the taxpayer a refund or claim the taxpayer owes money and usually threatens dire consequences if not paid, said Iwan of the Center for Internet Security. The IRS will not initiate contact with taxpayers by email or any other form of electronic communication. If you receive an email claiming to be from the IRS, you should avoid clicking on any links or opening any attachment. You should also report the email to the IRS by forwarding it to phishing@irs.gov. Be Careful Where You Store Your Taxes More than 90 percent of Americans now electronically file their taxes, according to the IRS. While computers have expedited tax return preparation, security experts warn they are a risky place to store your personal tax data. "Tax returns are a treasure trove. They contain everything someone needs to steal yours and your spouse's identity. They can be easily stolen," Schouwenberg said. Iwan suggests once you file, store your taxes on an external hard drive or flash drive. You should also make sure you have up-to-date anti-virus, anti-malware, and firewall software. If you believe you are the victim of identity theft, contact the IRS Identity Protection Specialized Unit at 800-908-4490, extension 245.