This article will explain why investors in Nuverra Environmental Systems (NES) could lose 80+% of their investment over the next 12 months. The NES investor base is primarily retail investors, many of which blindly trusted Dick Heckmann and Jim Cramer, while 40mm shares (largely institutional investors) are short the stock. The key points:

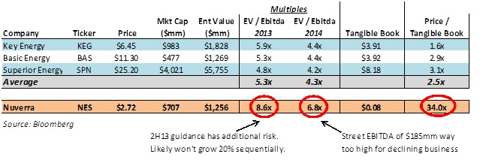

Rollup gone wrong: NES is a destroyer of capital and has yet to put up any decent results. The company has missed its guidance by 35+% in the last three years and yet to generate any positive operating profit. Misrepresenting itself: NES claims to be an environmental service company, when in fact it is just a simple oilfield service company (which trades at a meaningful discount to environmental service companies due to cyclicality and lack of differentiation). NES primarily owns trucks, tanks, and water disposal wells - nothing proprietary. The company is no different than the fluids service divisions of Key Energy, Basic Energy and Superior Energy. Founder jumped ship: Dick Heckmann saw the mess he created, handed off the reigns, removed his name from the company, and is distancing himself from this sinking ship. Extremely overvalued: The company is extremely overvalued relative to its peers (9x EBTIDA vs. 5x EBITDA) and only has $0.08 of tangible book value per share. Book value of $3.34 per share is extremely deceptive because it contains a massive amount of goodwill and intangibles from Dick's buying binge (where he overpaid for assets at the peak of the cycle). Over-levered with liquidity crisis looming: NES has $551mm of debt, and borrowing capacity has already been restricted on its credit facility. The company has slashed spending in order to generate cash, but NES is still set to violate its credit facility covenants by year-end. This is using updated guidance, which has always proven overly optimistic (note item #1). The impending default event will ultimately lead to a restructuring where equity holders are left with nothing.The Nuver! ra Investment Pitch - The Bull Story

NES is a full cycle environmental solutions company. The company is the leader in oil field waste management and is active in the most popular shale regions (Bakken, Marcellus, Eagle Ford, etc.). NES cleans up the dirty work of the oil industry. It is an investment in increasing oil activity and increasing environmental and regulatory scrutiny. A win/win.

With all the controversy surrounding fracking and its impact on water and the environment, investing in an environmental service company that services the oil industry sounds great. Especially a company put together by a well-respected entrepreneur with lots of water management experience. That seems like the specific reason this company came into existence, to sell the hype. While NES might look great on the surface, and makes for an interesting Mad Money pitch, let's peel back the onion a bit…

Heckmann Corp.'s History - The Reality

Nuverra, formerly known as Heckmann Corporation (HEK), is the brainchild of Dick Heckmann. HEK was started as a $500 million SPAC in 2007. For those unfamiliar, a SPAC is essentially a $500mm blank check for Dick to go buy something and create value. Why did people trust Dick enough to give him $500mm? The market was booming and Dick had experience in rolling things up and creating value. Keep in mind the 90s were a popular time for rollups, until many went bankrupt due to excessive leverage and poor results. We'll get back to Dick's "successful" track record in a bit. Dick struggled to find something to buy, but before the SPAC was going to dissolve, he purchased China Water and Drinks for $625mm. He thought an investment in China and water was an easy sell. Unfortunately, Dick didn't do his homework and, in 2010, announced that he purchased a complete fraud. Whups.

So Dick changed course. He saw the mania with shale development and the fracking controversy and started buying up water-related assets in popular plays, like the Haynesvi! lle. The ! new vision was to roll up small commoditized fluids service companies (that move fresh water to well sites, and remove dirty produced salt water). So that's what he did; he went around chasing the drilling hype and buying out private companies at the peak of the market (and paying a healthy premium - goodwill and intangibles are 95% of the equity).

HEK claimed to be a "water solutions company," when in reality it was a simple oilfield service company. Dick underestimated that the oilfield is a relationship business, and he had no experience in the industry. Things were going so wrong that in 2012 Dick purchased an oil recycling company in Arizona, which had nothing to do with the core business. With the word oil in it, though, HEK could now be a full environmental solutions company. All of the rolled up acquisitions were going so poorly that HEK was on track to violate its credit facility covenants. So what did Dick do? He made one last hail mary acquisition (Power Fuels), handed off the reigns, and has stepped away before his mess blows up. Even Jim Cramer has distanced himself from the company.

Dick Heckmman's Real Reputation

While most investors likely think that Dick Heckmann is a value creating genius that should be trusted with retirement money, they might want to temper their enthusiasm. Dick pioneered the roll-up strategy of creating "growth and value" through acquisitions. His previous company, US Filter, was a big success in the 90s as Dick rolled up water assets, completing over 150 acquisitions and growing sales from $17mm to $5b over the decade.

While the stock did great, and shareholders were rewarded, did Dick add real value? Let's look at the facts. US Filter was sold to an even larger rollup, Vivendi (VIVHY.PK), in 1999 for $7.9b. So what happened to Vivendi? It sold the US Filter water assets to Siemens (SI) in 2004 for just $993mm. Those assets remained a structural mess that never reached any desired margin targets. Dick's financial eng! ineering ! had worked for his shareholders, but it appears he didn't create much real value at all.

Disastrous Results

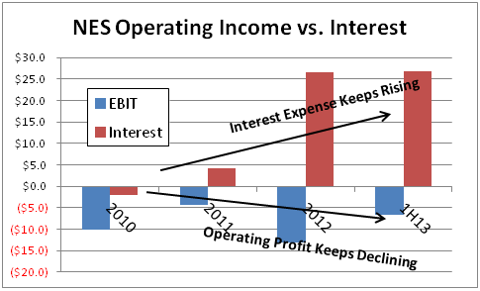

The numbers speak for themselves. NES has lost ~$7mm of operating profit so far in 1H13. In fact, NES has never generated positive operating profit (see below). And operating profit (EBIT) is before the millions of interest it must pay, which is growing as debt grows. The company has only generated positive EPS on a few rare occasions using some tax accounting magic.

(click to enlarge)

Guidance Consistently Wrong

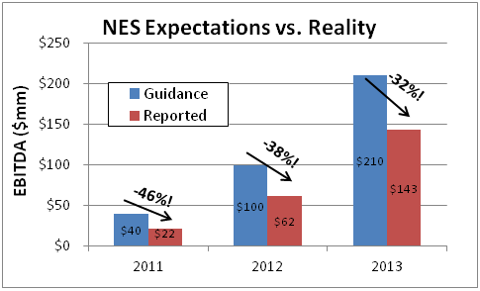

Most management teams tend to be conservative with their guidance. Not Nuverra. They have missed their guidance by over 35% for three years in a row; this is despite making a number of acquisitions to fill holes. 2011 missed by 46%, 2012 missed by 38%, and updated 2013 guidance is 32% lower than expectations from last quarter.

I challenge readers to find another company that has missed guidance so consistently and by such a large margin.

All Hail NES, the King of Adjustments

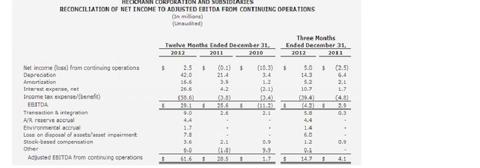

The only thing worse than missing guidance is the adjustments NES consistently makes to its financials to distort reality. "Adjusted" EBITDA is materially higher than real EBITDA and also includes a number of recurring expenses (stock-based comp, charges for relocating assets, etc.). The table below, from the bottom of the 4Q12 press release, speaks for itself.

(click to enlarge)

So are you starting to wonder why NES trades at a large premium to well-respected ! oilfield ! service companies that have put up consistent results? Keep reading…

Halliburton JV is a Façade

Most investors are excited and encouraged by the recent joint venture with Halliburton. Unfortunately, they don't realize that Halliburton's technology is disastrous to the water trucking industry (NES's primary source of EBITDA) and that it completely cannibalizes NES's business in the Bakken. Instead of transporting fresh water to new wells, removing salt water from producing wells, and disposing of it, NES will just be moving produced water to a new well for Halliburton. This cuts NES revenue generating opportunity by 75%! (p12)

And wasn't this rollup meant to be a growth company? Power Fuels generated $155mm of trailing twelve month EBITDA when it was purchased in 2012 as a growth company. The pro-forma business had $222mm of TTM EBITDA! Why is 2013 guidance just $140-145mm? That's because all of the rolled-up businesses are declining.

Power Fuels and Core Businesses in Decline

The Bakken has remained one of the most active basins in the country, yet Power Fuels results have collapsed. Why? Increased competition from new trucking companies entering the basin. Rental rates for tanks and other rental products have collapsed (excessive margins ultimately lead to oversupply). And E&P companies are investing in their own gathering and disposal systems for water. This completely disintermediates Power Fuels, and it has already shown up in the numbers (and likely gets worse).

In addition to Power Fuels, Nuverra's core fluids service business will continue to decline (barring a major pickup in activity) as a result of heavy competition and disintermediation from E&P companies (drilling its own disposal wells and sourcing its own water). Investors need to be aware that NES's core fluids service business is the lowest margin and most commoditized division for most oilfield services companies (who also have an integrated solution for water). Other oilfi! eld servi! ces (pressure pumping, coiled tubing, snubbing, drilling) are also commodity services, but much less so than trucking water and disposing it into disposal wells. The fluids service divisions of other oilfield service companies have been challenged this year due to oversupply from private and public players and disintermediation from E&P companies. Competition is expected to remain intense, and Nuverra will continue losing market share.

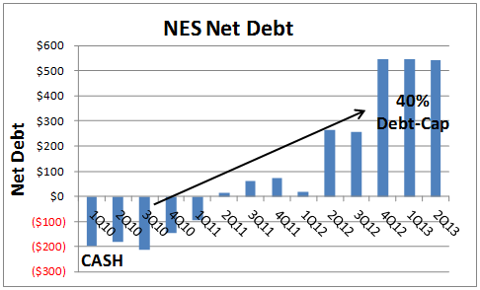

Default Around the Corner

What usually happens to over-levered rollups that don't deliver results? They blow up. NES has $400mm of senior notes and $130mm drawn on its $325mm credit facility. The credit facility has three covenants: minimum interest coverage ratio (2.75x), maximum total leverage ratio (4.00x), and maximum senior leverage ratio (2.50x). These can be found on page 39 of latest 10-Q. NES should have $195mm available on its credit facility, but borrowing capacity is already restricted to just $73mm because of its financial covenants (also p39). In fact, the only reason NES isn't already in default is because trailing results were so strong. That's the way it works with declining businesses, and why Dick bought Power Fuels - it bought him a year to escape!

Min interest coverage ratio (2.75x): With $13.3mm of quarterly interest expense, NES has to generate $146mm of TTM EBITDA ($13.3mm x 4 x 2.75) to avoid default. Max Total Leverage Ratio (4.00x): With $541mm of net debt, NES has to generate $135mm of TTM EBTIDA to avoid default. Based on the midpoint of 2013 guidance ($145mm of EBITDA), NES will trip a covenant and be in default by year-end. Keep in mind NES has always missed guidance, and guidance implies a 20% improvement in the second half of the year. 3Q13 will likely be stronger than 2Q13, but the downward trend will continue in 4Q13. If you annualize 1H r! esults ($! 65m x 2 = $130mm), the company would already be in default of both covenants.

Investors should be even more concerned given the robust activity - what would happen to NES if drilling activity actually slowed down? New management is aware of the impending liquidity problems and is trying to ward off future lawsuits. The new Q is full of cautionary language (p39-40) when old Qs barely mentioned the covenants.

Sky High Valuation at Risk - Fair Value 80% Lower

Despite all of these factors (disappointing and declining results, negative ROIC, management turmoil, liquidity and default risk), NES trades at a significant premium to its oilfield peer group (see below).

(click to enlarge)

What is NES really worth? Right now, I estimate fair value of ~$0.60/share. Using a half point turn discounted multiple (4.8x EBITDA), NES would be worth: $145mm in 2013 EBITDA x 4.8 - $541mm net debt / 253mm shares = $0.60/share. Does NES warrant a slight discount when it has a default risk? You decide. Could be arguably much lower. As I highlighted earlier, the $3.34 book value is deceptive because of the massive amounts of goodwill and intangibles. Tangible book is just $0.08/share.

Moreover, are the assets even worth its $0.08 book value? NES has never generated positive operating profit from them. Could they sell these assets? Most other similar companies are stuffed with trucks, tanks, and disposal wells. They don't want NES's used equipment because it would just add to their maintenance costs (to park more underutilized equipment). That's why I believe NES bondholders will also be at serious risk of not being made whole in the future, and their notes may ultimately be worth 50c on the dollar (or less).

Wrapping up

So that's the story on Nuverra. NES is a very risky investment with a high probability of bankruptcy.

If you disagree with the any of my an! alysis, w! hich is supported by facts, comment below. My intent was to inform, which was why you are reading this to begin with. The new CEO, Mark Johnsrud, is a great addition and a great manager. He has slashed capex, optimized working capital, and is aggressively cutting costs. NES was able to generate $13.5mm of FCF in 1H13 to pay down debt. Mark has slashed capex to a third of maintenance capex ($8mm of capex in 2Q13 vs. $22mm of depreciation) - likely at the expense of the long-term performance of the company and future growth - in order to try and save a liquidity event. He is a step in the right direction, but he is too late. Even he can't fix the levered mess that Heckmann created.

Disclosure: I am short NES. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article. (More...)

Alpha-Rich ideas are our best money-making long and short investment ideas. They are released exclusively to Seeking Alpha Pro users 24 hours before publication. Learn more about Seeking Alpha Pro.

No comments:

Post a Comment