I've been writing about Bank of America (BAC) pretty consistently now for the past couple of months, insisting that the bank is a buy for several reasons: it's overcoming legal obstacles, it has a good focus on fundamentals like cost, and its CEO seems to have a great head on his shoulders. In addition, Warren Buffett, who has already made enough on BAC to support the overhead of someone like myself until roughly the year 58 trillion, is letting his investment in the company ride after having a sit down with BAC's Chief Executive Officer about the state of the company and the economy as a whole.

A couple of weeks ago, I wrote an article profiling Buffett's visit with Bank of America:

Perhaps the lunch and meet up with Moynihan was a litmus test for Buffett, to try and get a grasp on his outlook - if not on the company - then at least how he feels about the sector and the economy from a macro sense. Any stock moves in the coming days from Buffett will be very telling. If he reports to have sold, he clearly wasn't happy with how things went. Should we hear silence, we can assume what we're assuming now: Buffett is still riding the Bank of America wave. QTR is bullish on Bank of America here, as well.

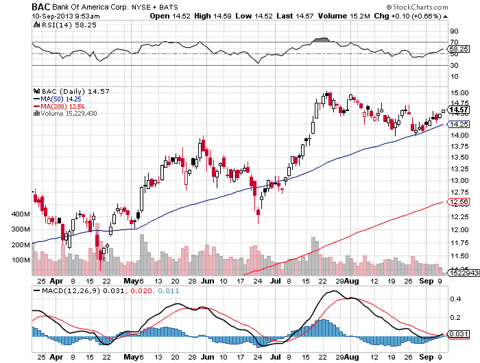

Well, we've heard nothing of the selling sort from Buffett since then, reaffirming my contention that he wanted to "ride the wave" and keep his money with the bank. Since that article on August 20, the stock has been performing well, bouncing around and over the mid $14 levels of late.

The company's stock has been performing consistently over the last year, having nearly doubled in price. Investors that have been in for the last three months have yielded a nice 9.2%, but those that have been in for the last 12 months have been rewarded with an upside that's pushing 70%.

(click to enlarge)

As I started to argue in my article "! Will Bank of America Break $14 And Fly On Earnings?" the stock appears to be in a very healthy uptrend - one that is likely to continue to the $15-$18 region if BAC can hold over $14. I commented on July 14 of this year:

If Bank of America can impress with this technical momentum behind it, the next step will likely be through $14, which will spur a larger rally in this investor's opinion. The RSI is looking healthy, not having been oversold for a few months, indicating there's technical room for the stock to move upward without being overbought.

Now, it appears we are riding that uptrend. So, what's new in Bank of America land, and have we any news that's going to catalyze or compromise this continued run up?

First, It was reported Tuesday morning that Bank of America, along with Alcoa (AA) and HP (HPQ) were going to be replaced in the Dow Jones Industrial Average. Yahoo reported:

Investment bank Goldman Sachs Group Inc. (GS), credit card company Visa Inc. (NYS:V), and footwear Nike Inc. (NKE) will join the blue chip Dow Jones Industrial Average, the index managers said Tuesday, replacing Alcoa Inc. (AA), Bank of America Corp. (BAC) and Hewlett-Packard Co. (HPQ).

The changes will be effective with the opening of trading on September 23, S&P Dow Jones Indices said in a statement.

The index changes were prompted by the low stock price of the three companies slated for removal and the index committee's desire to diversify the sector and industry group representation of the index.

So, while we can see that being removed on a basis like faltering company performance or something of the sort can sometimes be detrimental to companies, that's of no concern here. BAC was simply removed due to its share price - the DJIA swap does not weight itself by market cap - the "real" metric (O/S times PPS), where BAC weighs in at $157 billion. So far through early afternoon trading on Tuesday, BAC doesn't seem to be affected - trading up 0.18 to 14.66 at 12PM CS! T.

! In addition to the DJIA shakeup being a "non-event", BAC also announced Monday that it is going to continue to eliminate certain jobs by laying off 2,100 more workers and closing 16 mortgage offices. Bloomberg reported:

About 1,500 of the workers helped process home loans, said one of the people, who asked for anonymity because while affected employees were notified on Aug. 29, the scope of the plans hadn't been publicly announced. About 400 worked in a suburban Cleveland call center, and 200 dealt with overdue mortgages, the person said. The reductions are scheduled to be completed by Oct. 31, the people said.

Best Medical Stocks To Watch For 2014

Mortgage lenders are paring staff as higher interest rates discourage refinancing and cast doubt on how long the housing market rebound will last. Wells Fargo & Co., the biggest U.S. home lender, plans more than 2,300 job cuts, and JPMorgan Chase & Co. may dismiss 15,000. Bank of America's pending home loans fell 5 percent at the end of June from the previous quarter.

While layoffs and closings are always heartbreaking for the people involved, it is at the end of the day sometimes necessary to help continue to build value in the stock. At the very end of the day, the company has to answer to its shareholders, buckle down, and make the moves that are going to make continued investment in the company desirable.

In keeping with getting the fundamentals in order, and as I've covered ad nauseum in the past, CEO Moynihan has put his head down and knocked out an onslaught of BAC's legal woes through settlements, slowly and steadily, one at a time.

As I stated in another article about Bank of America, "Why You Should Ignore Bank of America's Legal Woes":

In all seriousness, this legal onslaught is a battle that the company has been at since earlier this year, as CEO Brian Moynihan has been systematically knock! ing lawsu! its out of the way slowly, steadily, and one at a time. The year started with a $1.7 billion settlement with mortgage insurer MBIA, which was mostly cash with a small investment in MBIA securities.

Although this DOJ civil suit is likely to give investors pause when they see the headline, it's likely to be settled for a much smaller amount than the others once it goes through the legal ringer headlines.

One point that concerns me is the fact that many of the jobs cut lie in the mortgage component of the company. One of the bullish stances I took on the company was that it was likely to improve from the housing recovery - so, this news wasn't incredibly exciting to hear and is likely a potential risk I'll keep my eye on going forward.

On the heels of more cost cutting and a meaningless drop from the Dow Jones Industrial Average, I am reaffirming my bullish sentiment on the company.

Although risk continues to exist, specifically in dealing with rising interest rates and downsizing the mortgage sector of the company in the midst of the housing revival, I'm fairly confident that BAC will hold its ground for shareholders. I also think it's likely that BAC will, at some point going forward, increase its dividends.

The attention that the company has been paying to aligning the fundamentals of the company have clearly continued to impress Warren Buffett, who still holds a profitable position on paper to the tune of $5B. In addition to Buffett, I remain impressed with the focus and execution that BAC has put into its cost cutting and fundamental management.

QTR is bullish on BAC here, and wishes all investors the best of luck, as always.

Source: Forget The DJIA Component Shakeup; Bank Of America Keeps Rolling In The Right DirectionDisclosure: I have no positions in any stocks mentioned, and no plans to initiate any positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article. (More...)

No comments:

Post a Comment