Top 10 Heal Care Companies For 2015

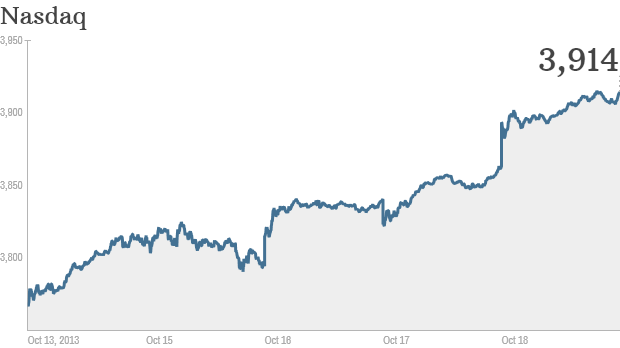

The Nasdaq rallied this week. Click the chart for more markets data.

NEW YORK (CNNMoney) With the government shutdown and debt ceiling showdown in the rear view, investors can breathe a sigh of relief -- for now.They'll turn their attention back to the economy and earnings.

The September jobs report, delayed by the government shutdown, will finally be released Tuesday. The report was originally scheduled to come out on October 4. According to economists surveyed by Briefing.com, it is expected that 183,000 jobs were added last month and that unemployment rate remained steady, at 7.3%.

This report won't provide any clues as to the effects of the government shutdown. But weekly jobless claims reports have already shown that impact. Last week's report, which covered the first portion of the shutdown, revealed unemployment filings from about 70,000 federal workers. Many will be forced to pay the benefits they received back, as Congress has approved to retroactively pay federal workers.

Stocks may also set some more records. The major U.S. indexes are all up sharply this year and held up well despite fears of a possible debt default. The S&P 500 ended the week at an all-time high while the Dow is about 2% off its peak of 15,709.60 from last month. The tech-heavy Nasdaq was even above 3,900. It hasn't been that high since the dot-com bubble burst in 2000.

Last week, the Nasdaq gained 3%, including 1% growth on Friday. The S&P added 2% -- and posted only one losing day last week -- and the Dow was up about 1% on the week.

Keeping an eye on earnings: The federal government shut down after the third quarter closed, but two of the largest federal government contractors may give some clues about the damage that was done during their latest earnings reports.

Lockheed Martin (LMT, Fortune 500), which reports results Tuesday morning, received almost $40 billion in government contracts last year and blamed the shutdown for causing at least 3,000 employee furloughs at the company. Dow component Boeing (BA, Fortune 500) releases earnings Wednesday morning. It landed nearly $30 billion in contracts last year, according to the General Services Administration.

Many other high-profile companies are on tap to! report their latest numbers, including McDonalds (MCD, Fortune 500), Netflix (NFLX), Caterpillar (CAT, Fortune 500), Ford Motor (F, Fortune 500), AT&T (T, Fortune 500), Microsoft (MSFT, Fortune 500) and Amazon.com (AMZN, Fortune 500).

What the iPhone 5S costs Apple

What the iPhone 5S costs Apple New iPads coming? The biggest tech event of the week isn't likely to be an earnings report. Apple (AAPL, Fortune 500), which isn't set to release its latest results until October 28, is holding an event on Tuesday. The company is widely expected to unveil its latest iterations of its iPad tablet. Apple's stock is still well below its all-time highs from September 2012. But shares have rebounded lately and are back above $500 thanks to indications of strong demand for its new iPhone 5S. Apple investors will be hoping that the new iPads will continue its recent hot streak. ![]()

No comments:

Post a Comment